Payroll Reporting with EZ-Report

Pay-as-you-go billing

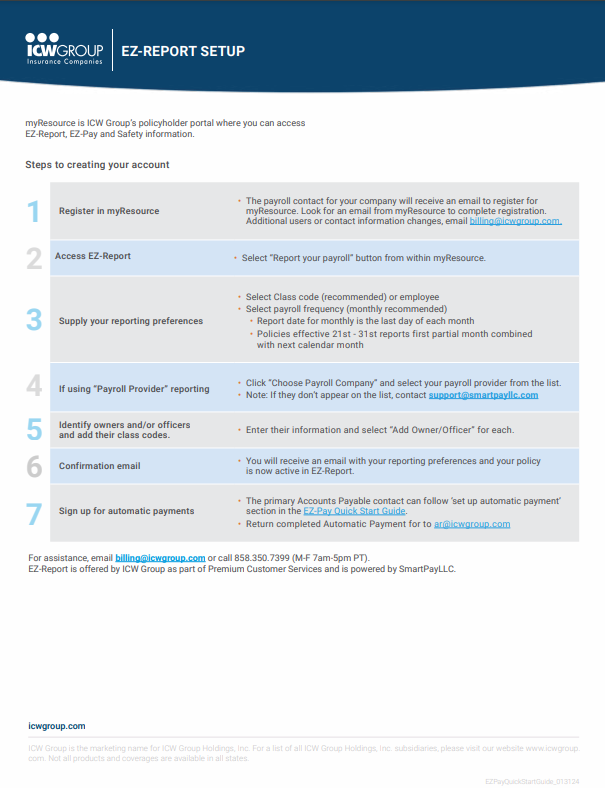

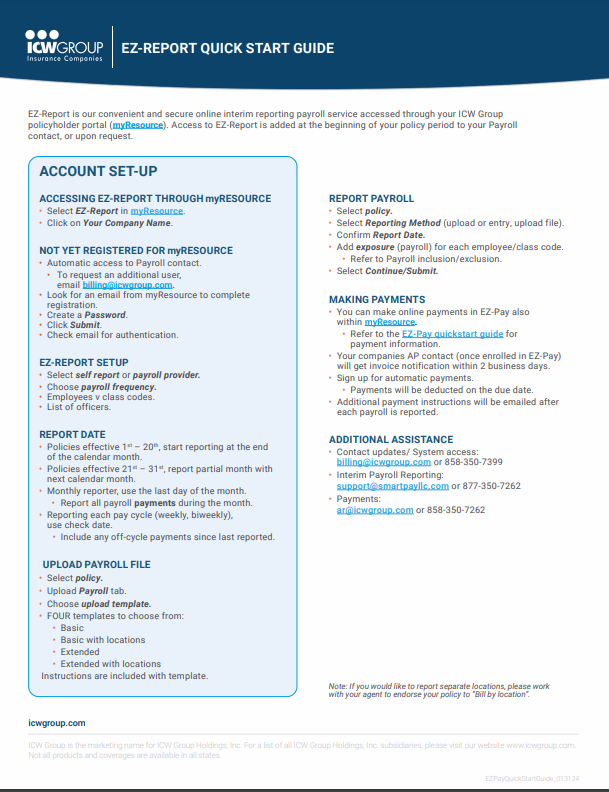

As a payroll reporting customer, the ICW Group Insurance Companies EZ-Report system simplifies your reporting process. Payroll entry and payments are a breeze! See our helpful resources below. If you have any questions, call us at 858.350.7399 – we’re happy to help!

For answers to your questions, check out the Payroll Reporting FAQs ›

For payment information, check out Make a Payment.

For policies effective prior to 3/2/2024, refer to PayPro information

For information on final audits, check out the Your Final Audit Page ›

View the EZ-Report Terms of Use ›

Payroll reporting references

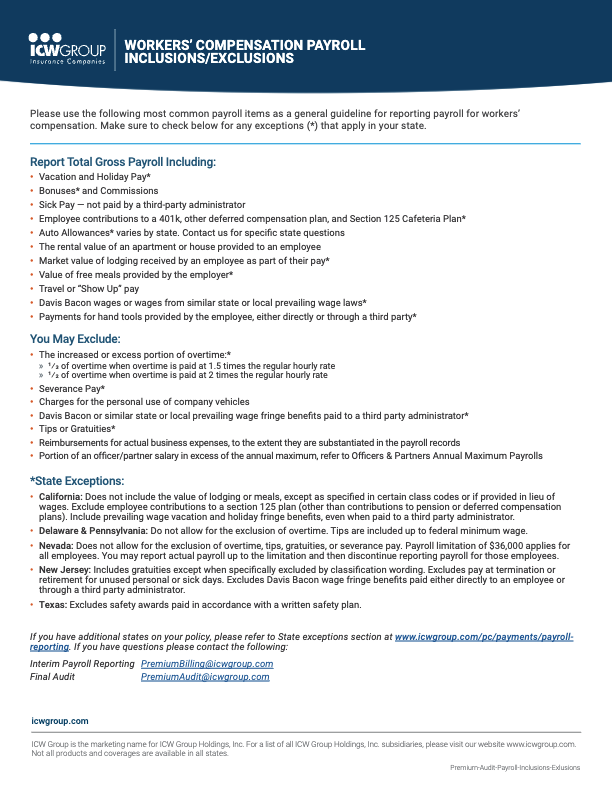

Workers’ Compensation Payroll Inclusions/Exclusions

Determines what to include for Workers’ Comp reporting.

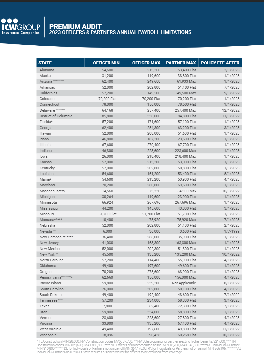

Download PDF2023 Officers & Partners Annual Maximum Payrolls

Lists the maximum payrolls

for officers and partners in each state.

Download PDFfor officers and partners in each state.

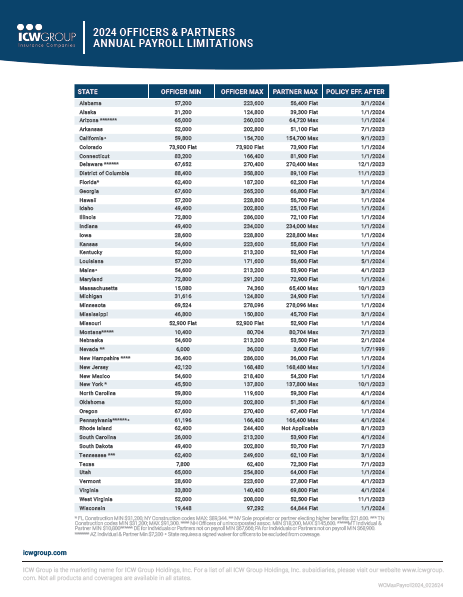

2024 Officers & Partners Annual Maximum Payrolls

Lists the maximum payrolls for officers and partners in each state.

Download PDFState exceptions

While most of the payroll rules are the same, see below for possible exceptions in your state.To see payroll reporting exceptions in your location, use the state selector above.

See exceptions in all states

Arizona

Do not include the value of lodging in payroll, except as specified in certain classifications. The value of meals should not be included. Exclude only Davis Bacon fringe benefit payments paid into an ERISA qualified third-party pension plan.

California

Do not include the value of lodging or meals, except as specified in certain class codes or if provided in lieu of wages. Exclude employee contributions to a section 125 plan (other than contributions to pension or deferred compensation plans). Include prevailing wage vacation and holiday fringe benefits, even when paid to a third party administrator.

Note about dual wage construction classifications

See the California Time Record Requirements (PDF). If the auditor is unable to verify classifications at the time of audit, all payroll must be placed in the highest rate, regardless of the wage level.

Colorado

Davis Bacon Act fringe benefits provided separately by employer should not be included.

Florida

Do not include awards for employee achievements or discoveries, pure gratuities, or results of a voluntary profit sharing program.

Kansas

Can exclude Vacation, Holiday or Sick pay if shown in records.

Kentucky

Payments/allowances for hand tools should not be included.

Louisiana

Exclude special reward for achievements or discovery, pure gratuities or the result of voluntary profit sharing arrangements if not part of an employment contract.

Mississippi

Include expense reimbursement if records do not confirm expense was incurred as a business expense.

Nevada

Do not allow for the exclusion of overtime, tips, gratuities, or severance pay. Payroll limitation of $36,000 applies for all employees. Report actual payroll up to the limitation and then you may discontinue reporting payroll for those employees.

New Jersey

Include gratuities except when specifically excluded by classification wording. Exclude pay at termination or retirement for unused personal or sick days.

New Mexico

Bonuses paid under a state approved safety program should not be included.

Oregon

Do not include vacation pay or unanticipated bonus pay, amounts payable under profit sharing agreements or payments that are part of a program to reward workers for safe working practices. Only Davis-Bacon fringe benefits paid into an ERISA qualified third-party pension plan may be excluded.

Pennsylvania

Do not allow for the exclusion of overtime. Exclude special rewards for discovery or invention.

Tennessee

Include bonuses only when paid in lieu of wages and specified as a part of a wage contract.

Texas

Exclude safety awards paid in accordance with a written safety plan and the value of special rewards for individual invention or discovery.

Virginia

Do not exclude Davis-Bacon wages even when paid to third-party pension trusts.