What is Work Comp Insurance

Work comp is a familiar term for workers’ compensation insurance. This unique type of coverage provides cash benefits and/or medical care for workers who are injured or become ill as a result of their job. Most every state requires employers to carry work compensation insurance, and many mandate it even for businesses with just one employee. Workers’ comp is unique because it operates as a “no-fault” system: employees don’t need to prove their employer was negligent to receive benefits. However, certain instances are not covered, like when drugs or alcohol are involved, or when workers are injured outside of work.

This article will provide a basic understanding of what goes into workers’ comp rates, what information is needed for a workers’ compensation quote, and what the lifecycle of a policy looks like. You can also find helpful tips for keeping your average cost of workers’ comp insurance as low as possible through proper risk management.

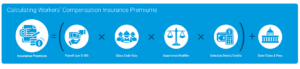

How Are Work Comp Premiums Calculated

Several factors go into the cost of workers’ comp insurance, including how many employees a business has and what type of work they do. Workers’ comp insurance quotes are calculated according to employee classification (class code) and the rate assigned to each classification. The premium rate is expressed as dollars and cents per $100 of payroll for each class code. This classification rate is then multiplied by the policyholder’s Ex-mod. The Ex-mod factor is a multiplier used to calculate the policyholder’s workers’ comp quote. It reflects how their claims history compares to other businesses similar in size and types of jobs. For more on this calculation, see the graphic below:

How To Get Workers’ Comp

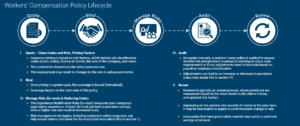

Wondering how to get workers’ comp insurance and what’s involved? Workers’ comp is secured through an agent, broker, or by going to the coverage carrier directly. You will be provided with a premium quote by the carrier’s underwriter. Once you secure a workers’ comp insurance price and choose to move forward, the quote will then be bound (formalized) and coverage will begin on the start date of the policy.

Throughout the life of the policy, a responsible carrier will help you keep your workplace safe and manage risk exposure through what’s known as risk management. Staying up to date on safety compliance and holding regular safety trainings and inspections are all smart ways to keep workers safe and your Ex-mod low. This helps ensure your workers’ comp insurance cost doesn’t go up due to accidents in the workplace. Note that ICW Group offers one-on-one safety consults to all policyholders as part of their policy. To learn more about that and our other aspects of our risk management program, pay us a visit online.

At regular intervals, the policy will then be audited to confirm that the business is still classified correctly and that payroll and employee classifications are up to date. These things often shift for a business over time. Premium audits can result in premium adjustments, and come renewal time, companies that have good safety records may realize a premium savings for the coming policy year. To learn more about how to prepare for a premium audit, see our article on the topic, complete with a useful video.

For more on this lifecycle of a workers’ compensation insurance policy, see below:

How To Choose a Work Comp Carrier

Once you have a workers’ compensation insurance quote in hand, you do want to consider a few other factors before choosing a carrier. While it is important to consider cost, you won’t want to focus solely on how to save money up front and not look at the entire life of the policy, or the costs involved in the event that you do have to file a claim.

In addition to workers’ compensation rates, business owners should consider how the company would respond if there were a workers’ comp claim. Do they keep claims response in-house or farm it out to a third party? Do they carefully vet each claim for fraud? What about helping manage prompt medical care for the injured worker through something like an on-call nurse phone line?

Other policyholder perks to look for in a carrier are robust risk management services, as well as a return to work program (RTW). RTW is a plan to help injured workers return to work that can help improve outcomes for both the worker and their employer in the long run.

For more information on how workers’ compensation premiums and work comp insurance work, please see our article on the topic.